Credit information

365 million companies worldwide

Avoid unpaid invoices by only doing business with solid companies.

Limit risks with reliable and up-to-date data

Finding a good balance between accepting new customers and limiting financial risks can be very challenging. New clients are essential for the growth of a company. But how do you know whether it is safe to do business with an organization? And how do your sales and credit management departments work together optimally? The solution is in good data and insights.

Dutch credit information

International credit information

Monitoring

Discretionary limits

More chances,

Less risks

With the credit information reports of CreditDevice you can better estimate the financial risks as an entrepreneur. You can also see future opportunities beforehand and adjust your plans accordingly together with your sales team.

So business safely

Strategic decisions based on up-to-date data

As an entrepreneur you need up-to-date data in order to substantiate your decisions. At CreditDevice you can take the word ‘up-to-date’ very literally. Updating our database is a continuous process: we actualize and check various data sources on daily basis. In this way we guarantee that you always have access to the most recent company information. This reduces the change of unpleasant surprises and unpaid invoices.

Three advantages of credit information

A new customer is always welcome. However, you want to be sure that your invoices are paid on time and your customers comply with the payment agreements, so that you do not miss out on sales or get into financial trouble. When going into business with a new company you need to make informed decisions based on as much data as possible. Credit information is essential when it comes to customer acceptance.

- Avoid unpaid invoices

- Limit risks

- Spent less time on debtor management

- Always insight in the payment behavior of your (potential) clients

- Know exactly for which amount you can do business

- Discover commercial opportunities

It is obviously no guarantee that a customer continuous to pay its invoices in time. After all, a lot can happen in the world, in a specific branch or company level. That is why CreditDevice can monitor your existing clients. This means that you always know directly when something changes. Is there a new director, deteriorating payment behavior or a suspension of payments? You will hear it the same day. By monitoring your customers, you always see the risks in advance, and you can make decisions accordingly. You for example only deliver on prepayment. Or you only accept an order with a down payment. In this way you hedge risks.

- Always insight!

- Act immediately when a risk profile changes

- Do business in a more targeted manner: you do not only see the risks, but also commercial opportunities

- You decide yourself when, how and with how often you want to receive notifications

More information about monitoring? Check out our Risk Manager tool

A credit insurance does not make credit information irrelevant. On the contrary! Sometimes you can grant a credit limit yourself without consulting your insurance company. This is called a ‘discretionary limit’. The credit limits of CreditDevice are accepted by all large credit insurance companies. Thanks to our reliable and up-to-date credit information. Are you credit insured? Ask your account manager for more information about PolicyManager. A tool which we developed to easily manage your credit insurance policy.

CreditDevice credit information

taking it a step further

Basic data comes from the trade register. CreditDevice takes it a step further when compiling a credit report. We are constantly searching for information we can add to our reports to limit the credit and fraud risk of our clients even further. We use data from more than 10,000 sources. Here you should think about real estate data, car data, the company website and many other (public) sources.

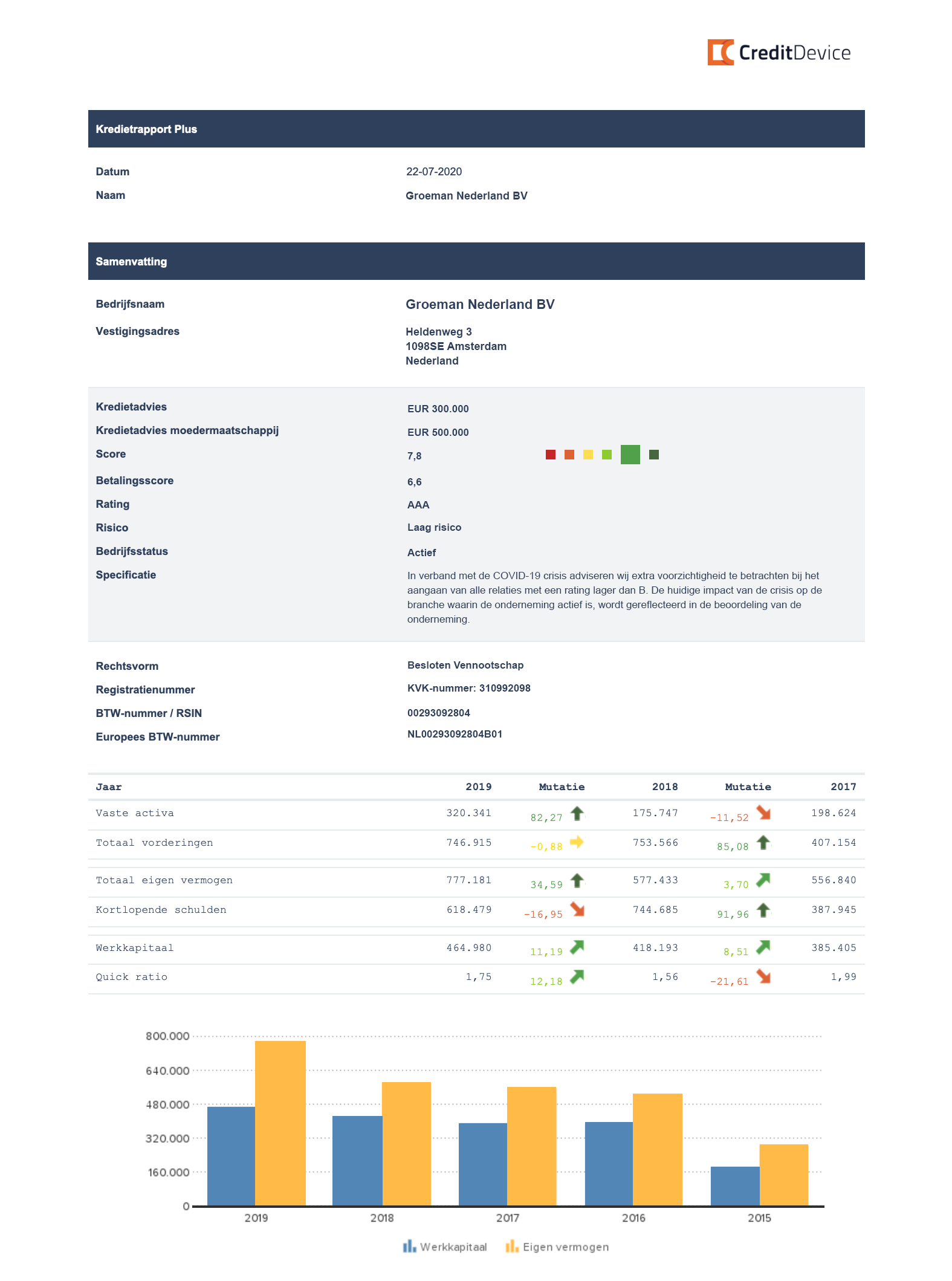

Which information can I find in a credit report?

- Company data

- Contact details

- Risk indicators

- Payment behavior

- Activities

- Corporate structures

- Real estate

- Management

- Key figures

- Annual figures

- Car data

- Branch analysis

- Court rulings

Always up to date

Payment experiences

Do you always want to be aware of the payment behavior of your customers? Then an annual account is not enough as this is just a snapshop of the past. CreditDevice offers much more. Thanks to the link with our credit management software, we have an enormous amount of payment experiences. Because we include the payment behavior of your (potential) clients in our credit reports, you immediately get a very predictive insight into the risks.

Request a free credit report

Why CreditDevice?

In the credit reports you find a clear explanation of the financial data. Before we started working with CreditDevice, we had to write our own explanations. It is so handy that we do no longer have to do this! Such a solution from CreditDevice is fantastic: we can immediately send the reports to our colleagues. As the information is understandable for everybody. We do not have to add anything and get fewer questions.

“In addition to improving the internal processes, a good customer acceptance process ensures that the DSO drops and the cash flow also improves. At SUEZ we are very satisfied with the results since the new customer acceptance procedure: a decrease in the number of depreciations by more than 70%. This is a big profit because it does not only mean that we have less depreciation, but we can also spend our time much more efficiently. ”

“Since collaborating with CreditDevice, Sligro has undergone an important change when it comes to the approach and perception of credit management. When we still had a classic approach, the focus was purely on debtor risk. Can we do business or not? Now that we have a more proactive approach, we are thinking more in terms of possibilities. So no longer just "it is not possible to do business", but "under what conditions can we do business". "

Contact

Questions?

We are here to help! Please contact us or request a quotation.