PolicyManager

Your new best friend

PolicyManager has been developed in consultation with Atradius, Coface and Euler Hermes to optimize and facilitate the management of your credit insurance policy. A tool that helps you prevent risks by performing actions on time.

Affortable subscription

Did you know that you can manage your policy for a low rate with PolicyManager? So the product is affordable for SMEs too.

You save time

PolicyManager saves you a great deal of manual labour and searches. Time you can better use to prevent losing coverage.

Automatic

From now on you will always be on time thanks to PolicyManager. Because you are automatically alerted in the event of payments that are in arrears, or credit limits that have been exceeded.

Discover the advantages

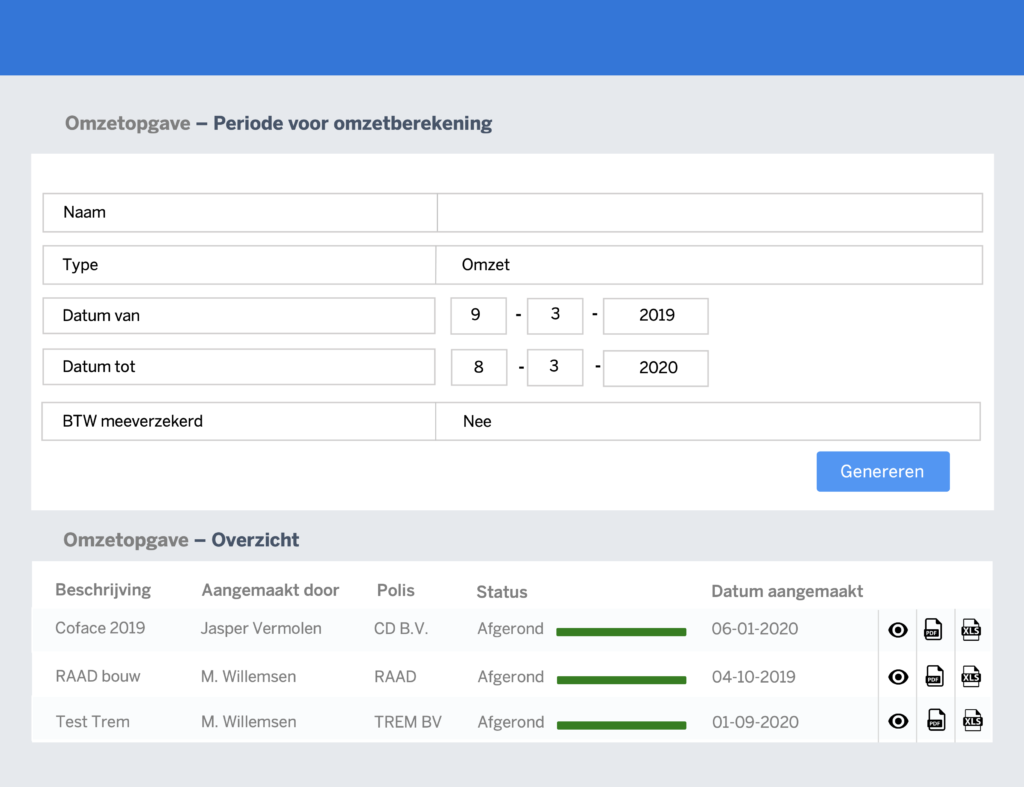

Do you also find it difficult to properly manage the rules of your credit insurance policy? Then PolicyManager is your new best friend. Manually managing a credit insurance policy takes a lot of work: you need to stay focused, take all the rules and conditions of the policy into account and coordinate and interpret the daily information flow. PolicyManager takes care of all of that for you. The web service with the credit insurer sees to it that information is exchanged automatically. The system automatically generates new lists and notifications for every update, minimizing the chance of errors. On top of that, it saves a lot of time. From now on, you never have to look for what you need to do right now.

Up-to-date credit limits

Always up-to-date data

PolicyManager guarantees that the status of your credit limits is kept up to date. This always keeps you up to date with the current situation.

Up-to-date information regarding coverage is essential for credit insurance policies. You don’t want goods to be delivered if a limit has been withdrawn by the insurer, for example. That is why PolicyManager takes care of the updating on a daily basis – or sometimes even several times a day. It is possible to request new limits and you can immediately see every decision, withdrawal or reduction. Overviews are also easy to request: this saves manual labour and is less error-prone. Furthermore, PolicyManager can make data available to other internal systems, bringing them up to date immediately as well.

PolicyManager

The tool to manage your credit insurance policy.

Why PolicyManager?

The credit limit costs can mount up if you have a large number of debtors. However, PolicyManager makes unnecessary costs a thing of the past.

Credit limit costs are a part of any credit insurance policy. PolicyManager makes it easy to analyse what credit limit best suits your customer and how to get coverage at the lowest costs. Sometimes it is possible to cancel a credit limit or replace it with a (free) self-assessment limit based on your payment experiences. PolicyManager helps you make the calculations and, if you do business with a customer on a regular basis, it is the least expensive option. You can also choose to determine the coverage using a CreditDevice credit report. This is not free, but often less costly than the insurer’s credit limit.

Determining a limit yourself based on payment experiences requires a lot of calculations. PolicyManager does this for you. You get your credit limit and the accompanying calculations all at once. Many companies find it hard to make optimum use of discretionary limits within their policy conditions. PolicyManager uses the same calculation method as the insurers and thus provides you with a credit limit for free.

Credit insurers have a rule: one company, one limit. When companies have multiple entries in your administrative system with several debtor numbers, PolicyManager offers the solution. PolicyManager recognizes these companies and links all invoices from the various debtor numbers to a single limit, giving you a clear overview. We use the company registration number (or chamber of commerce registration number) as the key.

A credit report is the ideal instrument for determining a covered credit limit. Credit information is very valuable for risk management, all the more so if the financial data is fully integrated into all the software modules and the reports are affordable. That is the case for PolicyManager.

When a claim arises, the insurer asks about the determination of the self-assessment limit. You will find an up-to-date flagging overview in the PolicyManager file. Very convenient in cases of damage. Two mouse clicks give you an Excel document with the flagged invoices and the relevant history.

Combine different modules

All in one

The CreditDevice credit management modules let you combine everything in a single application: your debtor management, your credit insurance policy management, credit information collection and risk analysis.

PolisManager as a standalone is an excellent instrument to properly manage a credit insurance policy. But the credit management software and the policy management software together offer even more possibilities for improving your credit management. Some of our clients even take this one step further: they import financial data about their customers from our credit information database, which allows them to produce cross-sections of their customer portfolio and helps them to assess risks earlier. In short, CreditDevice offers ample possibilities to improve and scale up your credit management and is the only provider in Europe to offer such a total package.