Credit management software

Workflows

Structure your management cycle to create more overview, save time, improve processes and manage in a customer-oriented way.

Debtor management

Improve efficiency with Workflows

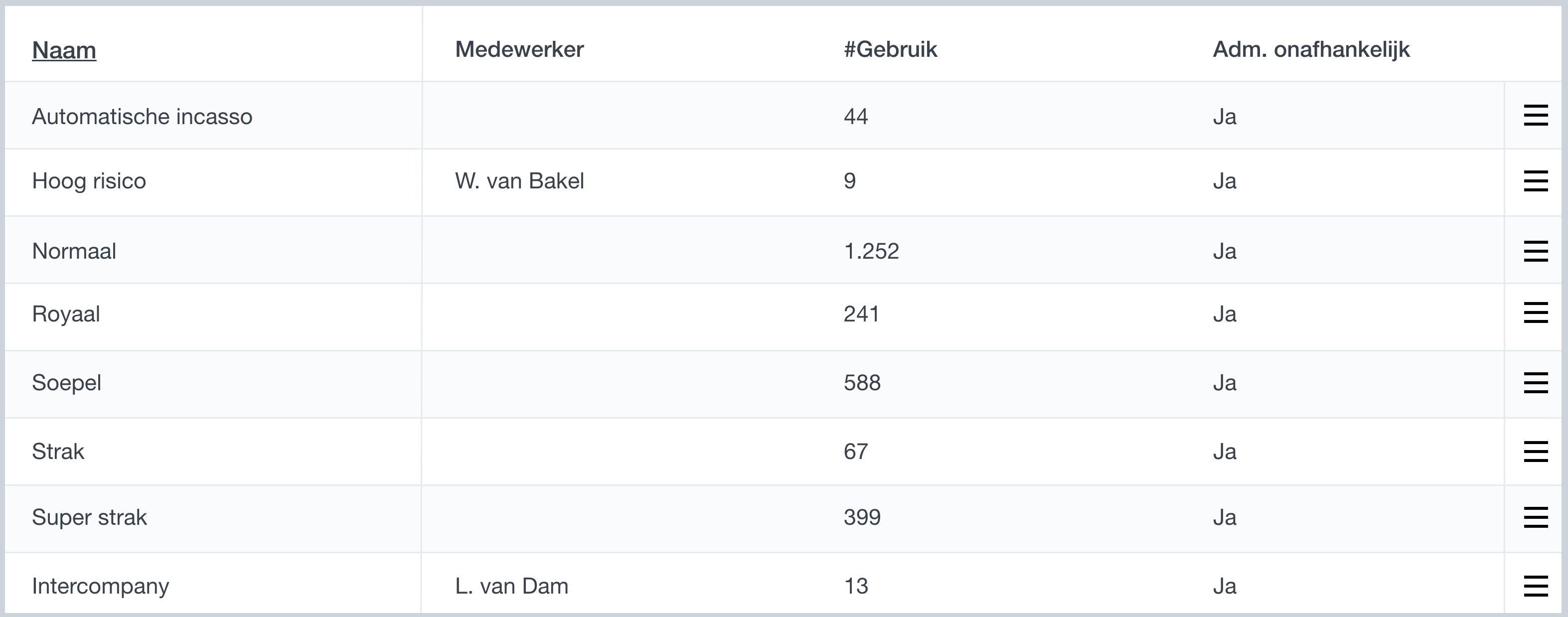

The use of CreditDevice Workflows in accounts receivable management can greatly improve the efficiency of your department. Each customer group is different. The CreditDevice workflows can be customized to remind each customer in the most effective way. For example, adjust the workflow based on impact, risk or region. This way you always choose the right approach that fits the type of company.

The use of CreditDevice Workflows in accounts receivable management can greatly improve the efficiency of your department. Each customer group is different. The CreditDevice workflows can be customized to remind each customer in the most effective way. For example, adjust the workflow based on impact, risk or region. This way you always choose the right approach that fits the type of company.

Always up to date

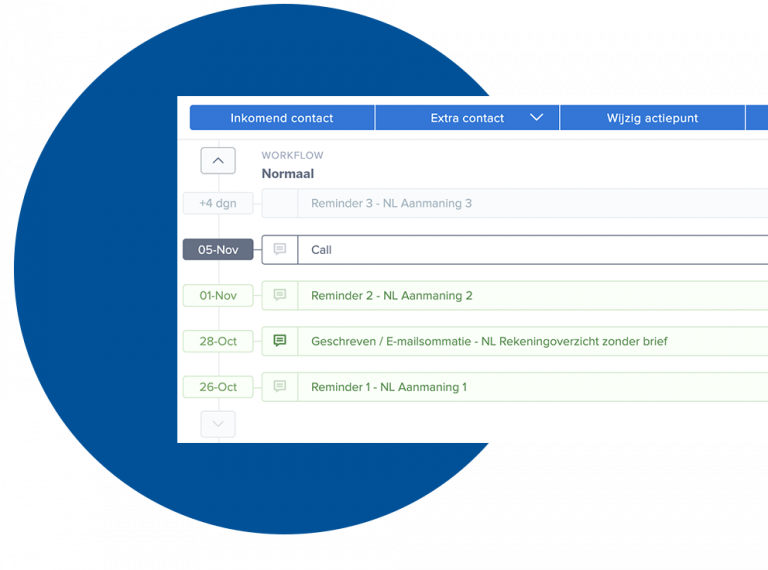

With the CreditDevice workflows, your employees are always aware of the current status of accounts receivable management. With a proper design of the workflows, the software ensures the daily execution of all set actions. Whether it’s that first reminder or that last reminder: there is a tight follow-up on all overdue invoices. This also ensures that the work of an absent colleague can easily be taken over. By setting up the workflows correctly, you also automate unnecessary manual work. You not only save FTEs; your employees can also focus fully on their core tasks.

All benefits at a glance

With CreditDevice’s Workflows you can:

- Save FTEs by automating processes and actions

- Targeted reminders per debtor group

- Never miss an overdue payment again

- Always send reminders on time

- Get invoices paid faster

- Minimize manual work

- Easily take over the work of colleagues

- Include QR codes in your letters or text messages

All benefits at a glance

- Save FTEs by automating processes and actions

- Targeted reminders per debtor group

- Never miss an overdue payment again

- Always send reminders on time

- Get invoices paid faster

- Minimize manual work

- Easily take over the work of colleagues

- Include QR codes in your letters or text messages

Workflows

Set up per customer group

How do you have contact with your debtors? Individuals are often at work during the day. Contacting them by telephone during office hours is often costly and ineffective in relation to the outstanding amounts. Larger companies need a personal approach. Is this the first time someone has paid late or do you have to chase up arrears every month? Is the PO number on the invoice? Did the invoice arrive correctly? And maybe you can even deliver the invoice to the debtors digitally. How you have contact with your customer, differs per customer group. Workflows from CreditDevice make far-reaching segmentation possible. The right information and settings ensure that you can guide the customer in a convincing way to pay on time next time.

How do you have contact with your debtors? Individuals are often at work during the day. Contacting them by telephone during office hours is often costly and ineffective in relation to the outstanding amounts. Larger companies need a personal approach. Is this the first time someone has paid late or do you have to chase up arrears every month? Is the PO number on the invoice? Did the invoice arrive correctly? And maybe you can even deliver the invoice to the debtors digitally. How you have contact with your customer, differs per customer group. Workflows from CreditDevice make far-reaching segmentation possible. The right information and settings ensure that you can guide the customer in a convincing way to pay on time next time.

Credit management for your company

Find the solution that suits you

Workflows as the key point of your debtor management

By properly recording the workflows in your debtor management software, you ensure that processes always run efficiently, in a structured way and partially automatically. You will also have a clear picture of which step in the cycle the debtor is in and who is responsible for it.

Contact

Request a free demo!

Please contact us for a quotation without any obligations.