Get the most out of your credit insurance

Prevent unwanted limit costs or claims

The benefits at a glance

With PolicyManager

Generate a premium calculation with one click, in a format accepted by the credit insurer;

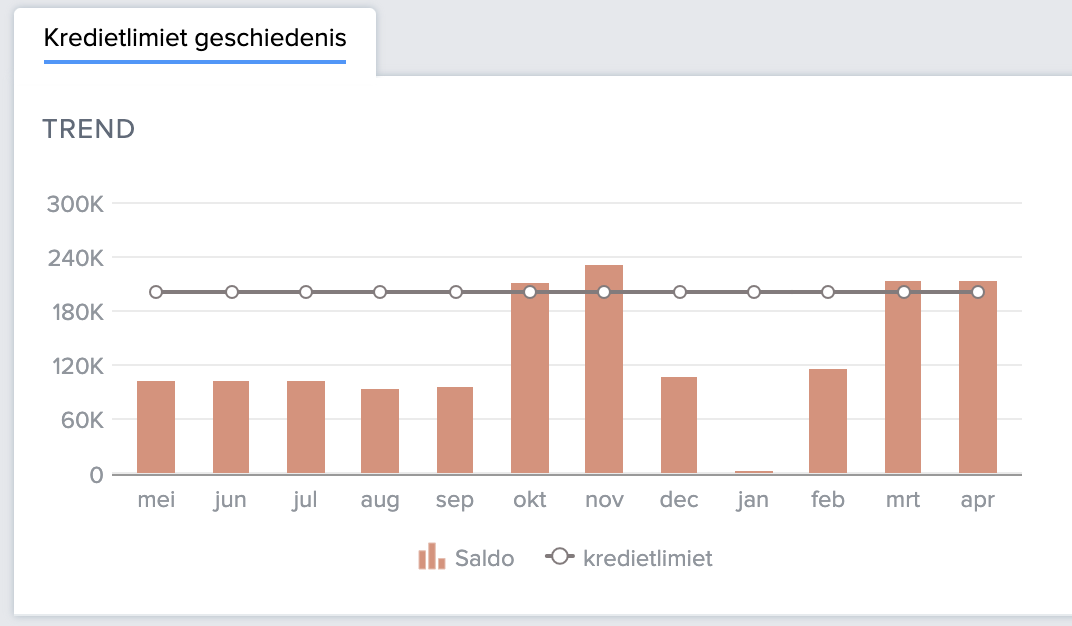

you will receive a notification when a debtor has an outstanding balance higher than his credit limit;

you no longer need to calculate the discretionary credit limits on the basis of payment experiences; the software does this for you;

all credit limits both from the credit insurer and payment experiences and/or credit information reports are automatically updated in your ERP package;

Never make mistakes

Never forget to take action, as all the important notifications for efficiently managing your insurance are prepared for you. Such as:

backlog and dispute notifications;

add claims via the portal;

cancel limits that are no longer needed.

Why PolicyManager?

“The use of PolicyManager saves us a lot of risk and time and gives us a form of security so that nothing can be overlooked”.

Tom Bravenboer

Harvest House

“By using the PolicyManager in combination with our credit insurance, Polvo bv has a better grip on its outstanding items”.

Sydney Jongenelen

Polvo BV

“We chose CreditDevice because it allows us to manage our accounts receivable and credit insurance conditions in one tool”.

Elleke Nauta

GP groot

Convenience and time-saving

PolicyManager:

processes limit changes directly from the insurer and ensures a permanent exchange of data thanks to the link between your ERP software, the credit insurer and PolicyManager.

ensures that all actions to be taken are automatically prepared for you – you decide what to send;

allows you to create an insured premium calculation and reports at one click.

ensures that the relevant persons within your organisation are informed in time about changes in the cover;

Looking for more information?

Request a demo

Discover what PolicyManager can do for your organization?